Unified portfolio intelligence

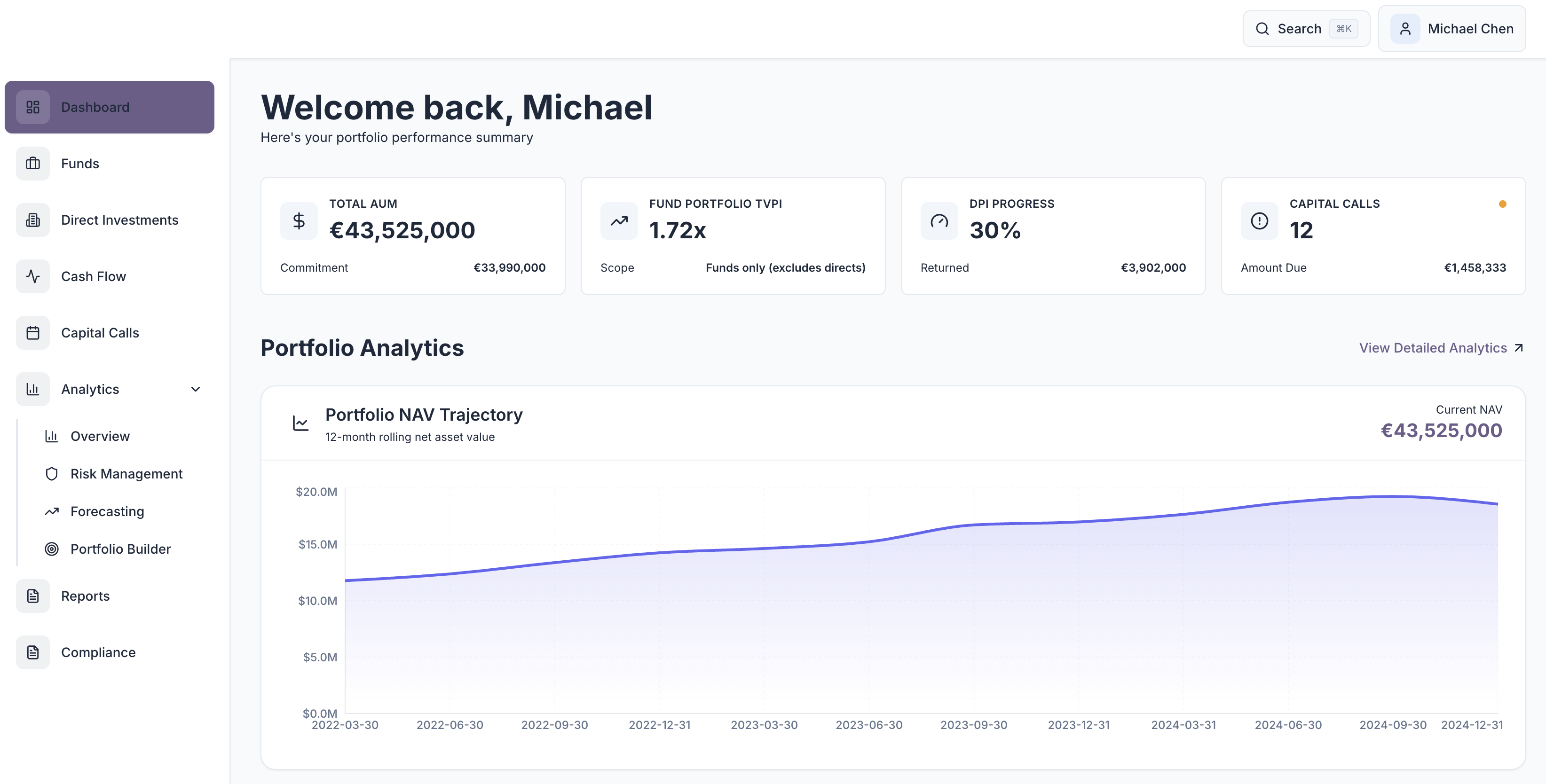

Funds and directs in one view with NAV, TVPI/DPI, and allocations by manager, geography, and asset class.

OneLP is the AI-native control center for LP teams—unifying funds and directs, capital calls and distributions, risk guardrails, forecasting, and board-ready reporting without GP portal juggling and manual workflows.

GP portals, PDFs, email threads, and spreadsheets make it easy to miss capital call deadlines, lose key documents, and overlook exposure.

Manual extraction and disconnected systems slow decision-making and introduce risk.

OneLP is the first AI-native operating system for LP teams.

Platform

Multi-asset coverage, disciplined capital calls, risk visibility, and reporting—delivered through a single AI-native workspace.

Funds and directs in one view with NAV, TVPI/DPI, and allocations by manager, geography, and asset class.

Pending call alerts, reconciliations, waterfalls, distribution timelines, and MOIC visibility across the portfolio.

Risk scoring, concentration alerts, stress scenarios (-15% / -30% / -50%), and liquidity/VaR with unfunded forecasts.

Generate custom reports using AI for ICs, boards, and auditors - with one sentence.

LP Operations

OneLP is designed to streamline & automate day-to-day tasks for LPs, advisors, and co-investor teams.

NAV trends, call statuses, compliance/tax packets, and a secure download proxy—organized and searchable.

PE, credit, real estate, public equity, and cash positions with revenue/ARR metrics, valuations, and exportable tables.

Instant insights for decision-making: NAV, TVPI, unfunded, timelines for calls vs. distributions, saved scenarios, and liquidity plans.

AI

Search, summarize, generate reporting, and forecast in the same secure workspace.

Ask “Show all capital calls issued in Q3” or “List risks above policy thresholds” and get source-linked answers in seconds.

Summarize any document, build board-ready reports, and message GPs without leaving the portal.

Product view

OneLP is the hub for LP operations, analytics, and decision-making.

Security

Invitation-only authentication, hardened sessions, rate limits, and enterprise-grade controls.

Row-level permissions, client-level separation, and SOC/GDPR readiness.

Granular fund permissions

Relationship-aware access (LP, advisor, co-investor) with exportable access reporting.

Hardened authentication

12+ char passwords, bcrypt hashing, 8-hour sessions, lockouts after repeated failed attempts.

Rate limiting & headers

Endpoint limits, anomaly detection, HTTPS/HSTS, CSP, referrer, and permissions policies.

Data residency options

Client-scoped separation with regional hosting; encryption in transit and at rest.

Advisory

Strategy, academia, and global family office expertise to shape OneLP.

Advisor, Strategy & Academic Partnerships

Two-time PhD and MBA (Cum Laude) from IE Business School. Vice Dean of Graduate Programs at IE University’s School of Science & Technology; background across software, consulting, retail, and media. Recognized for workforce development with Google’s Activate initiative and published in MIT Sloan and HBR. Guides strategy, partnerships, and private-market intelligence.

Advisor, Corporate Strategy & Family Offices

30+ years in corporate advisory and transactional strategy across New York and Madrid, serving UHNWIs and institutions via ONNI Capital Partners. Deep global network across London, Zurich, Hong Kong, New York, Rio, and Madrid. Informs GTM, relationships, and product design for private-markets workflows.

Advisor, Cross-Border Legal Strategy

Dual-qualified lawyer in Germany and Greece, leading an independent practice in Munich for private and corporate clients across real estate, corporate, and capital markets matters with a focus on transactions, litigation, and regulatory compliance. Background in real estate boutiques and the legal team of a multinational automotive group, plus judicial placements at the Regional Court of Munich I and the Public Prosecutor’s Office. Fluent in German, Greek, and English; LMU Law Degree and L.L.M. in International Dispute Resolution (IE Law School).

OneLP is the hub for LP operations, analytics, and decision-making.

We are currently onboarding pilot LPs and family offices with white-glove support.